38+ What is my mortgage borrowing capacity

Annual income monthly expenses and loan details. Reliable The assessment is more reliable than a visit to your bank or by using one of the many online.

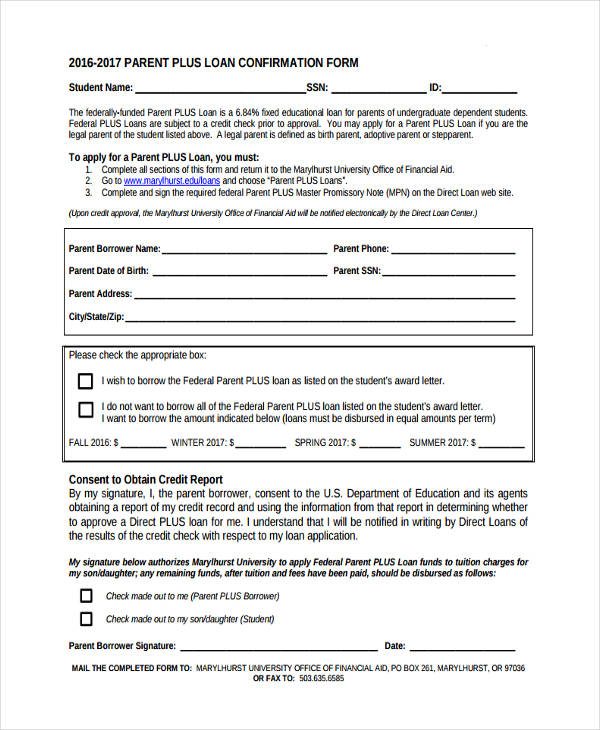

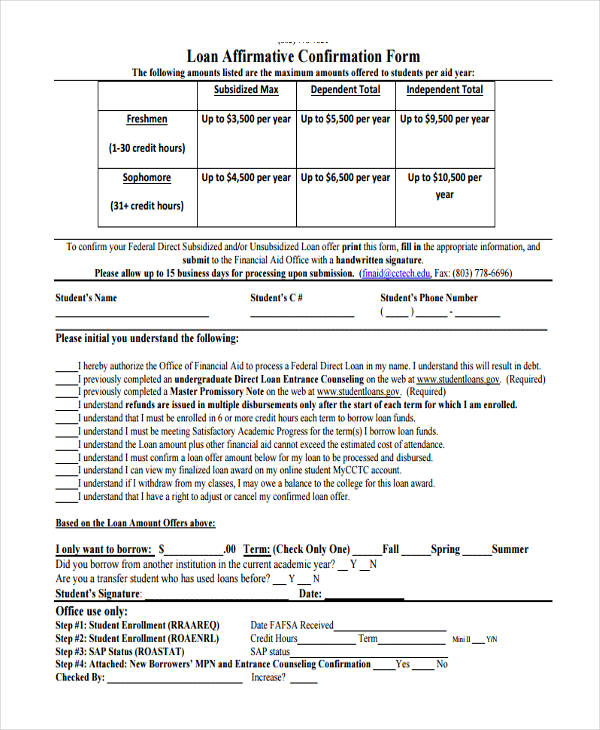

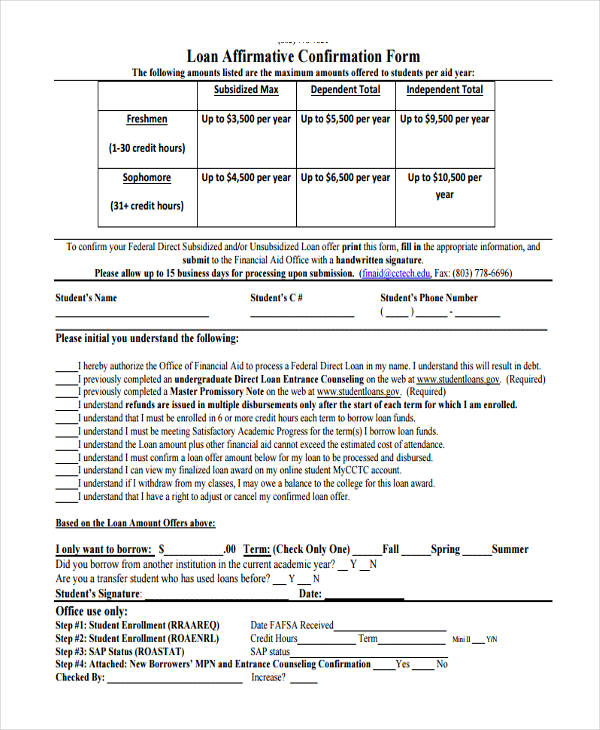

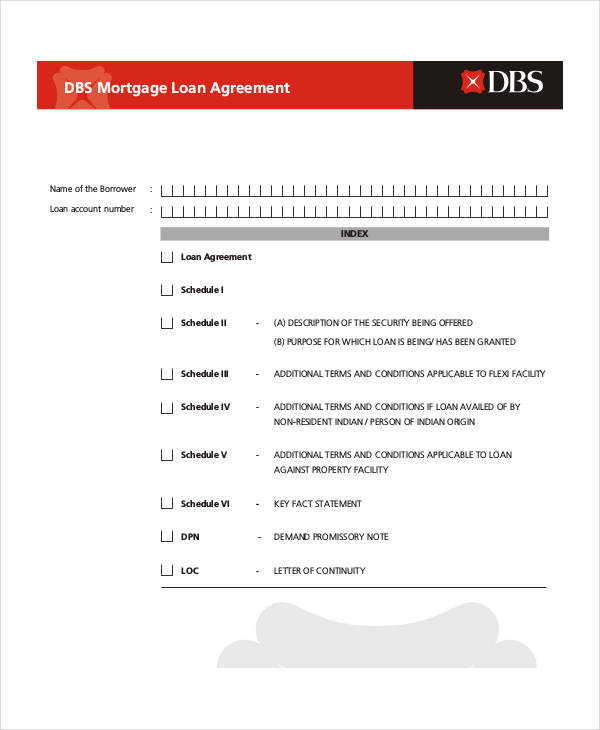

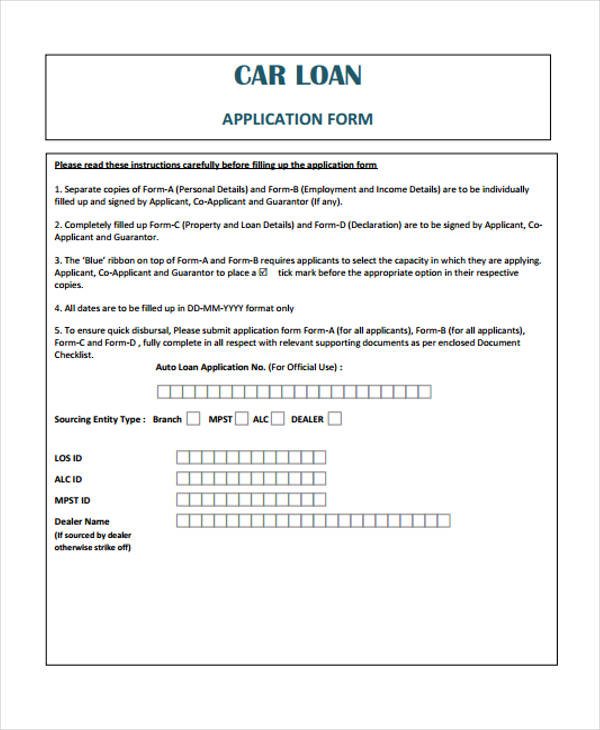

Free 8 Loan Confirmation Forms In Pdf

Similarly a longer loan term also means lower repayments.

. Borrowing capacity is the maximum amount of money you can borrow from a loan provider. Your borrowing capacity depends on your loan amount expectations the interest rate you desire and your own risk level. Get a quick quote for how much you could borrow for a property youll live in based on your financial situation.

Compare home buying options today. Use our borrowing power calculator to get an estimate for how much you can borrow for your home loan in under two minutes. Use our borrowing power calculator to get an estimate for how much you can borrow for your home loan in under two minutes.

Equity is the difference between your propertys market value and the amount of money you still have left to. Ad Highest Satisfaction for Mortgage Origination. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

View your borrowing capacity and estimated home loan repayments. It will also compare this level of maximum borrowing with the amount of mortgage you can afford to maintain. For an insured loan this ratio must fall in between 32 and 39 depending on the lender.

Borrowing capacity is defined by the amount you can obtain from your bank to finance the purchase of your future home. Calculate how much you can borrow to buy a new home. Ad Calculate Your Mortgage Payments With Our Calculator And Learn How Much You Can Afford.

Your borrowing power depends on your income deposit and credit score. Your borrowing power will vary between banks and lenders. Apply Online To Enjoy A Service.

On the other hand the longer you pay your home loan the more interest repayments and the higher the overall costs. This is usually required by the courts during the process of a divorce. Thus as part of calculating your borrowing capacity it is also wise to ask your lender what is going to be the interest rate for your loan.

Your Mortgages borrowing power calculator considers a few important factors that can determine your borrowing capacity or how much you would be eligible to take out on a home loan. There are three parts to this calculator. As a guideline when determining how much you can borrow banks and lenders will look at.

This calculator provides useful guidance but it should be seen as giving a rule-of-thumb result only. And before they approve you for a loan the financial institution must accurately predict that you will be able to financially keep up with your mortgage payments if interest rates were to rise. The exact amount will depend on the lenders borrowing criteria and your individual circumstances including how much equity you have in your property.

Frequently Asked Questions How Do You Increase the Amount I Can Borrow on a Mortgage. Reports should display the details of the person obtaining the report including the breakdown of their income. Calculate your borrowing capacity using this borrowing capacity calculator from Ethel Florence.

No credit check is involved nor is it a guarantee of the approved financing which you may receive by National Bank. If youre not sure just put an estimate. If you want a more accurate quote use our affordability calculator.

The mortgage capacity report is a detailed investigation into what level of mortgage you are likely to be successful in obtaining. It confirms the amount that National Bank agrees to lend. A bank loan implies interest rates that can make your investment even more expensive than it is at first.

How much you can borrow from the bank depends on the home loan type term and interest rate. Lower interest rates bring about lower monthly repayments. Its calculated based on your basic financial information such as your income and current debt.

It is a main component to determine the type of property that you can acquire. Get an estimate in 2 minutes. When the time comes to assess your borrowing capacity the first indicator used by financial institutions is the gross debt service or GDS.

When you want to borrow money to purchase a property specific data is analyzed by your mortgage broker and lender to determine your borrowing capacity. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you can borrow. Read more about what lenders look at in the.

The report could be required for both parties or just one. This ratio takes your annual housing expenses or renting expense by comparing them to your gross annual revenue. Therefore you have to relate your personal revenue and your.

A Mortgage Capacity Report is a document which provides details from a number of lenders on how much you can borrow as a single applicant. Save Time Money. Your borrowing power will vary between banks and lenders because they use different methods to assess your capacity and have different lending criteria.

If you save for a bit longer and have a bigger deposit we might be able to lend you more. Buying or investing in a new property we have a variety of tools and calculators to help you. Youll need to spend a little longer on this.

Fill in the entry fields. Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment. Examine the interest rates.

Estimate how much you can borrow for your home loan using our borrowing power calculator. You can improve your borrowing power by cutting out living expenses lowering debts and speaking to a mortgage broker. A mortgage pre-approval certifies your borrowing capacity based on several criteria including your credit rating.

Ad Work with One of Our Specialists to Save You More Money Today. Get Instantly Matched With Your Ideal Mortgage Loan Lender.

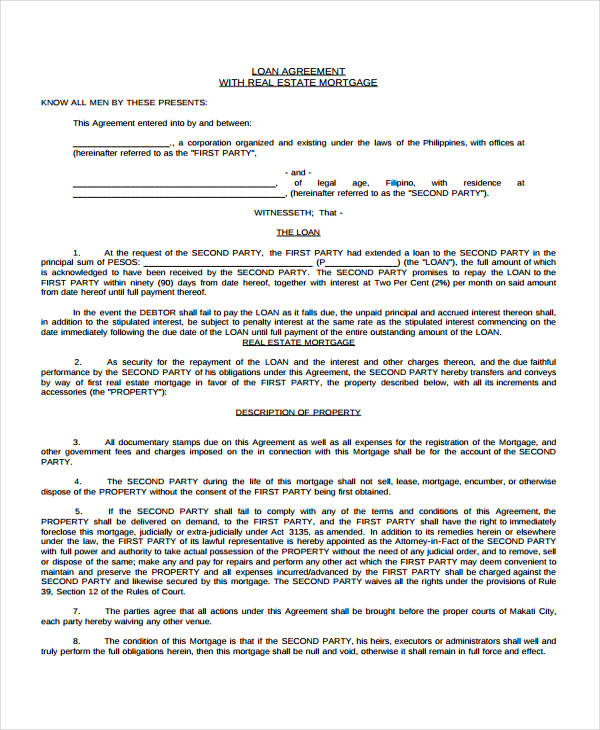

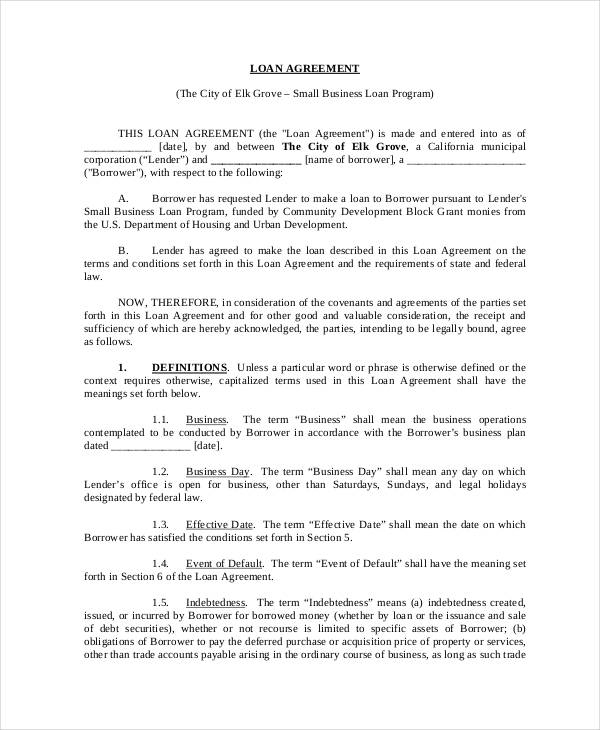

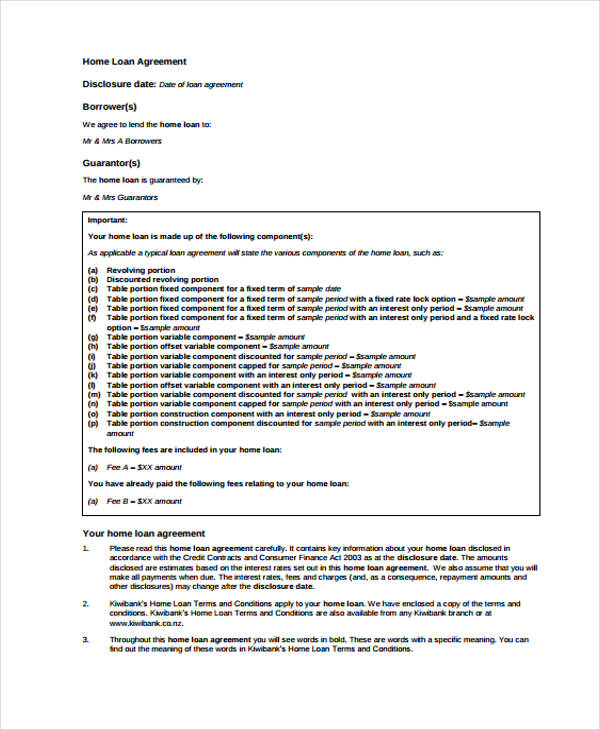

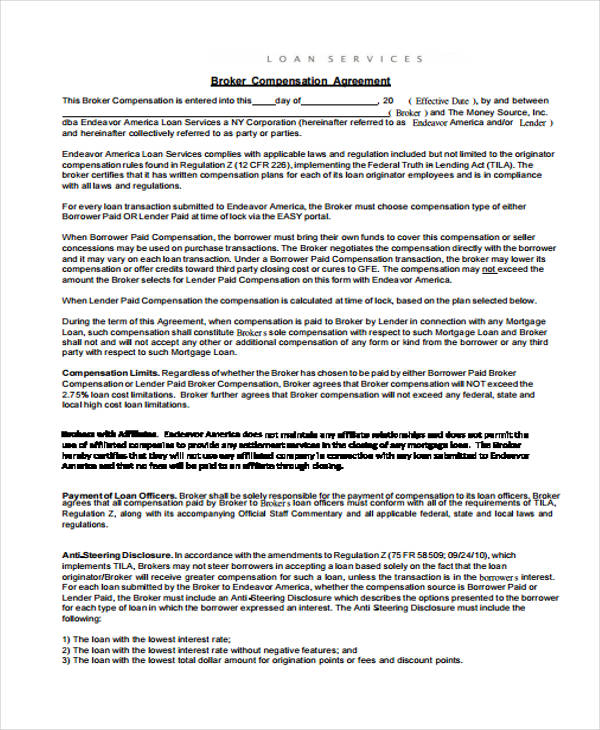

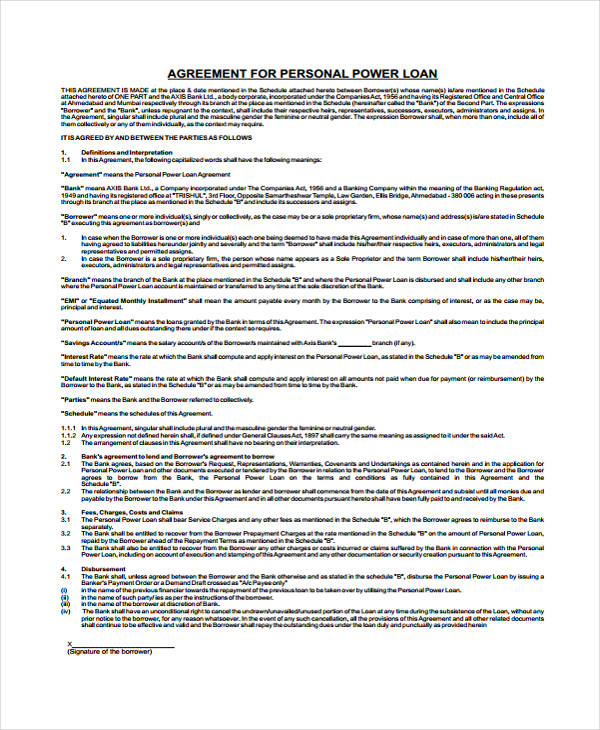

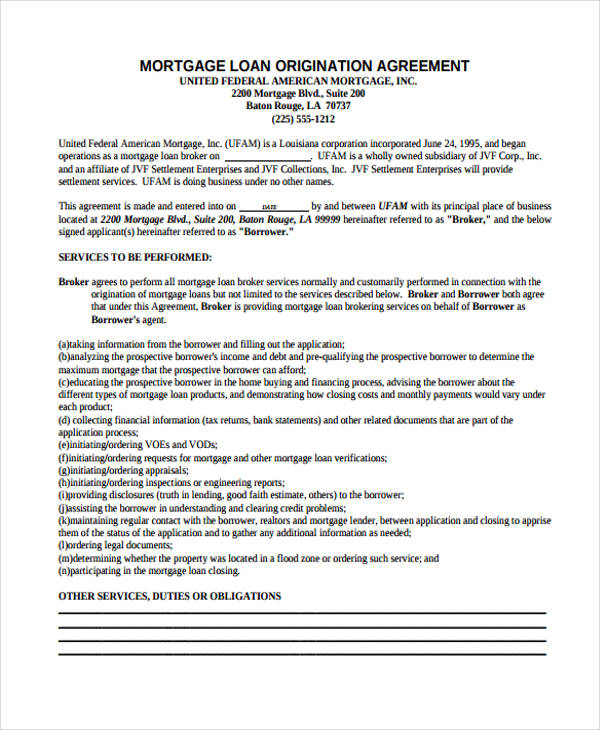

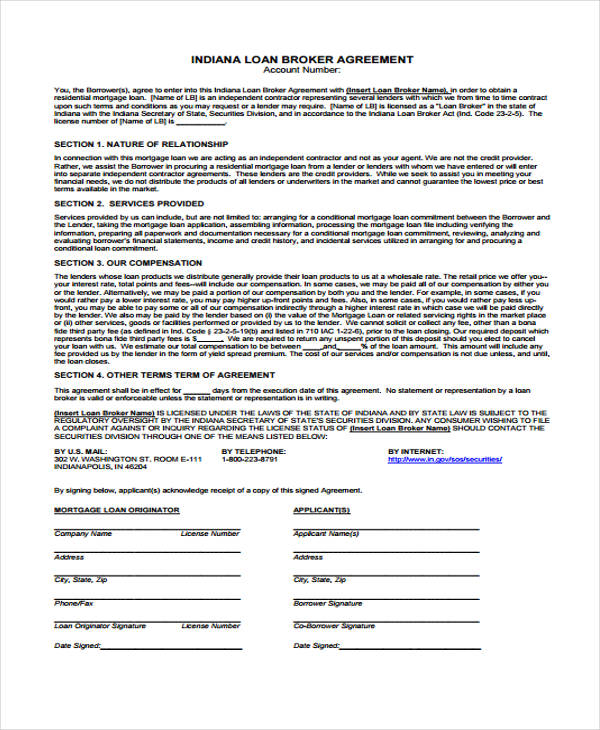

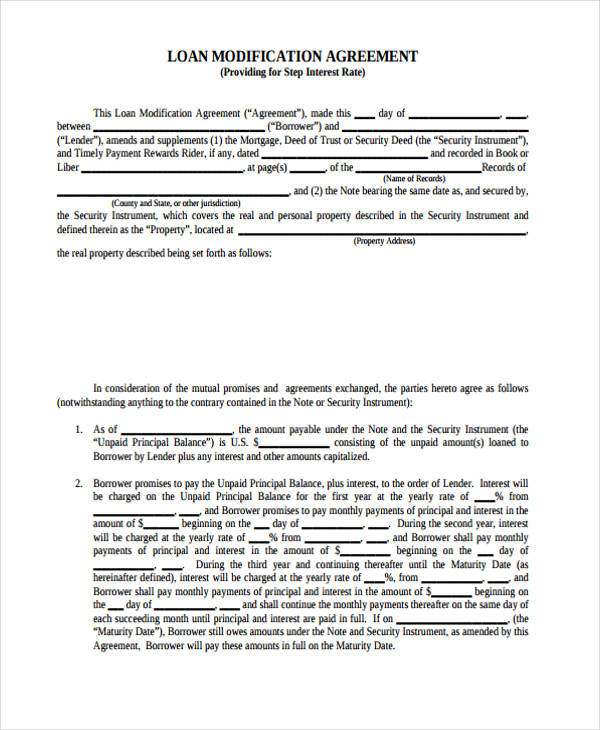

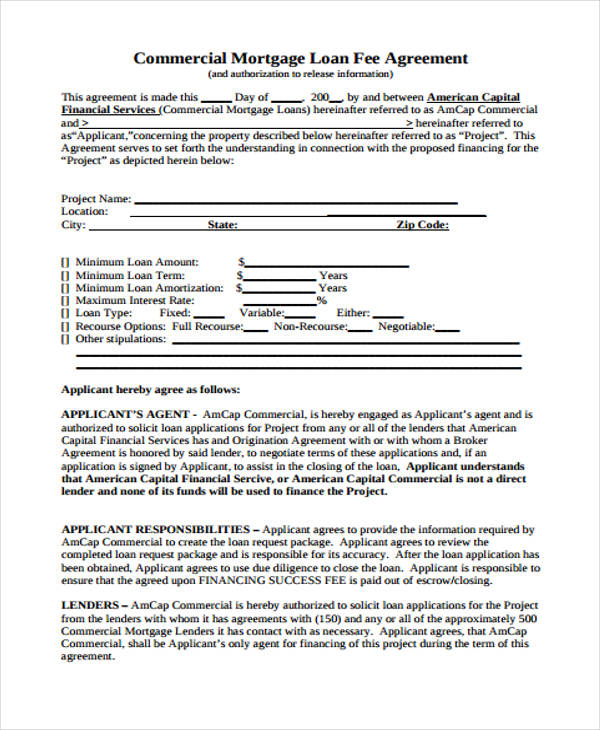

Free 56 Loan Agreement Forms In Pdf Ms Word

Free 35 Loan Agreement Forms In Pdf

Free 34 Loan Agreement Forms In Pdf Ms Word

Pin On Getting Organized

Free 65 Loan Agreement Form Example In Pdf Ms Word

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

Free 65 Loan Agreement Form Example In Pdf Ms Word

Free 8 Loan Confirmation Forms In Pdf

Free 35 Loan Agreement Forms In Pdf

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

Free 65 Loan Agreement Form Example In Pdf Ms Word

Free 40 Printable Loan Agreement Forms In Pdf Ms Word

Free 35 Loan Agreement Forms In Pdf

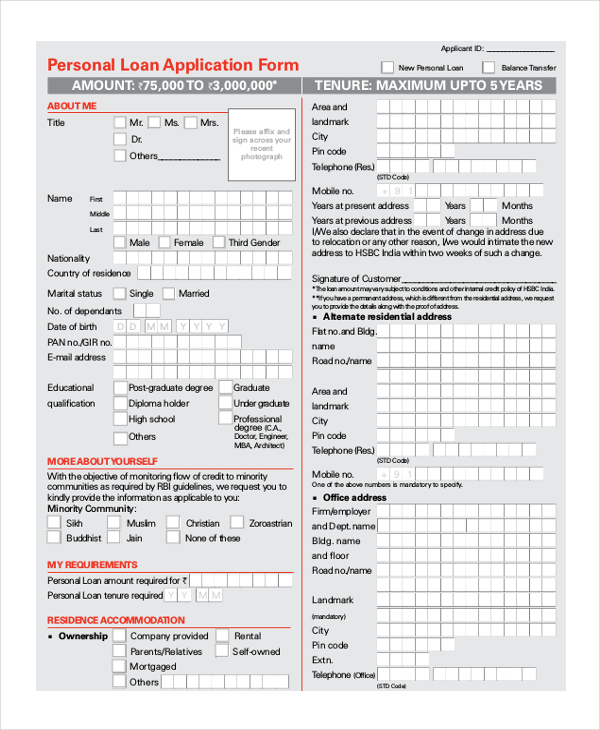

Free 13 Sample Loan Application Forms In Pdf Ms Word Excel